MoverAlerts Packing a Punch at The Movers & Storers Show 2023

The Movers & Storers Show is the UKs biggest event for the removal and storage industry. Launched in 2007, around 1,000 people from the world of movers and storers gather to network and more.

What: Mover & Storers Show

When: 21st-22nd November 2023

Where: NAEC, Stoneleigh, Warwickshire

With over 50 exhibitors and several seminars, attendees had the opportunity to find out about new products and services, discover the latest industry news and seek out new business opportunities. Amongst the amazing industry speakers were our very own MoverAlerts team members, Marlon Walters and Matthew Iskander.

If you missed the event, fear not. In this blog, we will share with you some of the key highlights that Marlon and Matthew discussed at their seminars, ‘Knowledge is Power,’ and ‘Understanding the Market to Maximise the Opportunity.’ The seminars focused on empowering attendees for achievement in 2024 and beyond.

.png?width=600&height=450&name=MicrosoftTeams-image%20(51).png)

A Roundup of MoverAlerts’ Industry Insight

Marlon and Matthew opened by commenting on how the press has been hell-bent on creating the picture of a downtrodden property market, consistently indicating that house prices would plummet, and the property market would be in tatters. The MoverAlerts team clarified the reality of what was really happening based on our parent company, TwentyCi’s data.

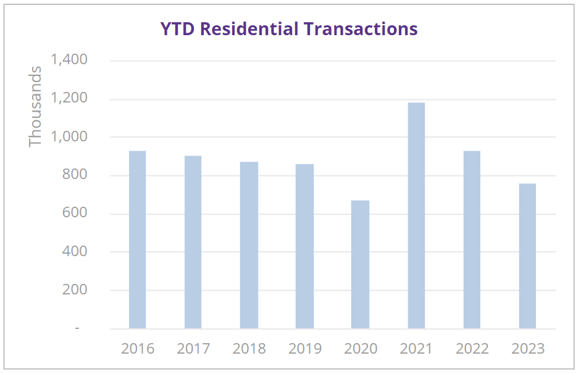

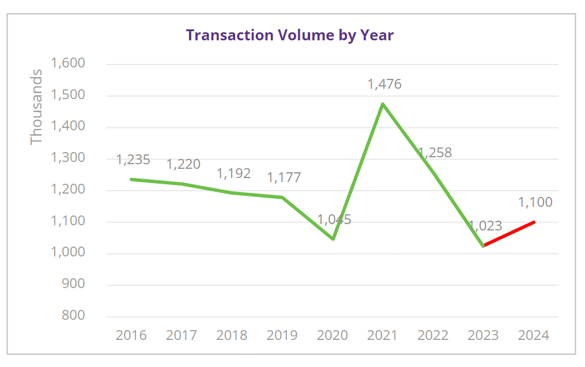

Transactions

Marlon and Matthew highlighted that whilst transactions were 12% down in 2023 versus 2019, they were always going to be as a result of Liz Truss’ mini-budget, the rise in interest and mortgage rates, the continuing war in Ukraine, the conflict in the Middle East and the cost of living crisis. When you take all of these economic disruptions into account, actually the property market has been very resilient in 2023.

Source: HMRC

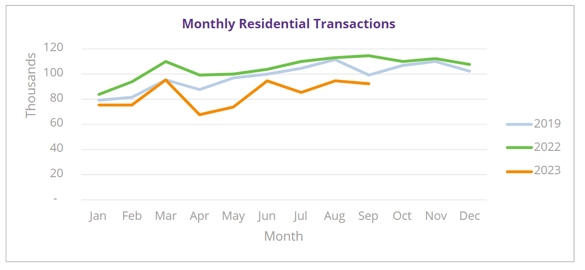

When you take a look at the monthly levels of transactions, there are signs that things are getting better:

Source: HMRC

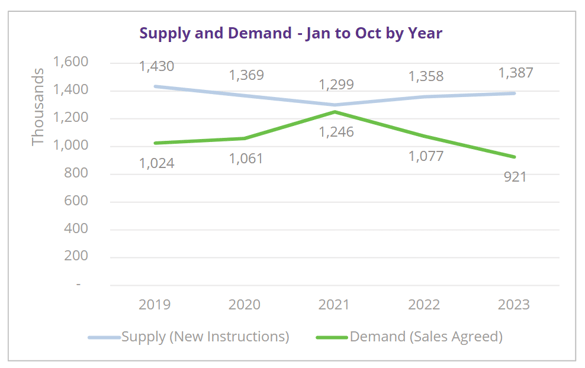

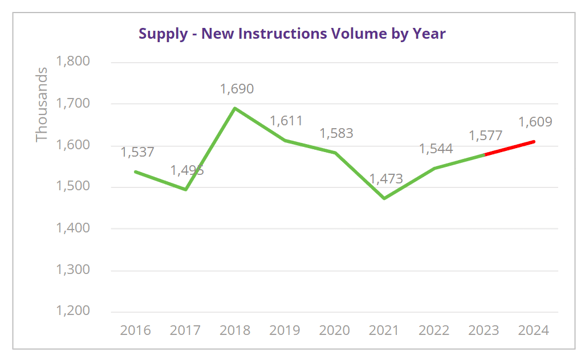

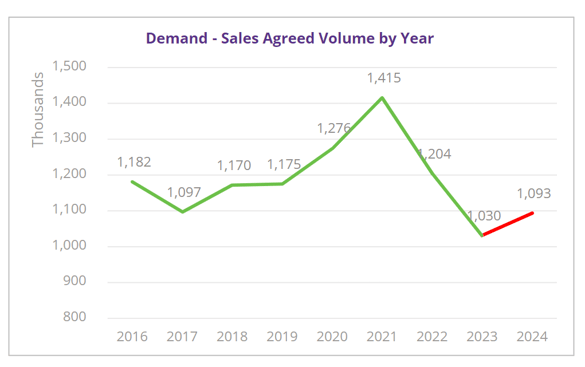

Supply & Demand

Whilst supply (new instructions for sale) is lower than in 2019 by 3%, it has actually risen by 2% in the last year. However, demand (Sales Agreed) is 10% lower than in 2019. The outlook for 2024 is better than it has been for this year, as Sales Agreed has not dropped by as many transactions.

Source: TwentyCi

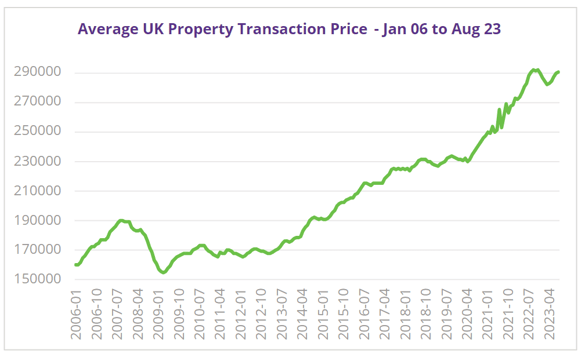

Prices

Taking the latest transaction prices released by UK HPI from August 2023, they discussed how the prices had risen by 0.2% per annum and 0.3% in the last month. The peak transfer price was in September 2022, prior to the mini-budget, at £292,982. Our insight suggests that prices will not fall by double digits and we’re not convinced that London will see any drop at all.

Source: UK HPI

Looking at what is happening in the economy, prices might not be falling for long. The UK currently has a backlog of 4.3 million homes according to the Centre for Cities. At the rate of new houses being built, the housing stock shortage is not going to be resolved any time soon. This lack of supply suggests house prices won’t continue to fall.

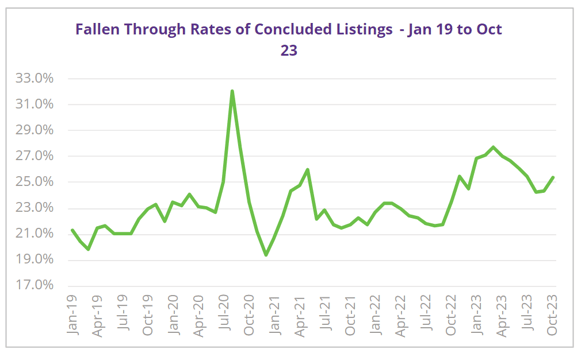

Fallen Through Rates

Fallen Throughs are worse now than 2019’s 22% average, with a Fall Through rate of 25.4% in October 2023. Whilst this may seem like bad news, you need to put into perspective that a massive three-quarters of properties do not Fall Through. What’s more, 75% that do Fall Through will sell again in the same advertising cycle, so these results aren’t that disappointing.

Source: TwentyCi

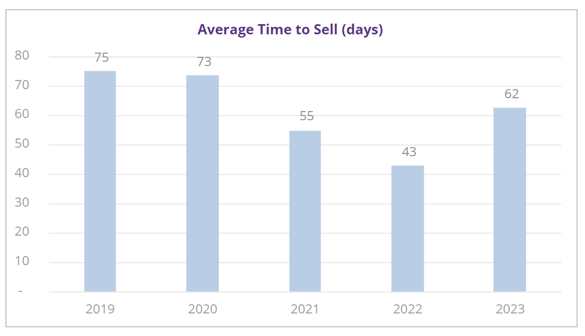

Time to Sell

The Time to Sell is measured as the time in days between a new instruction and a first sale agreed. Currently, the average time to sell a property in 2023 is 62 days. This is an increase of 46% from last year but a reduction of 17% since 2019.

Source: TwentyCi

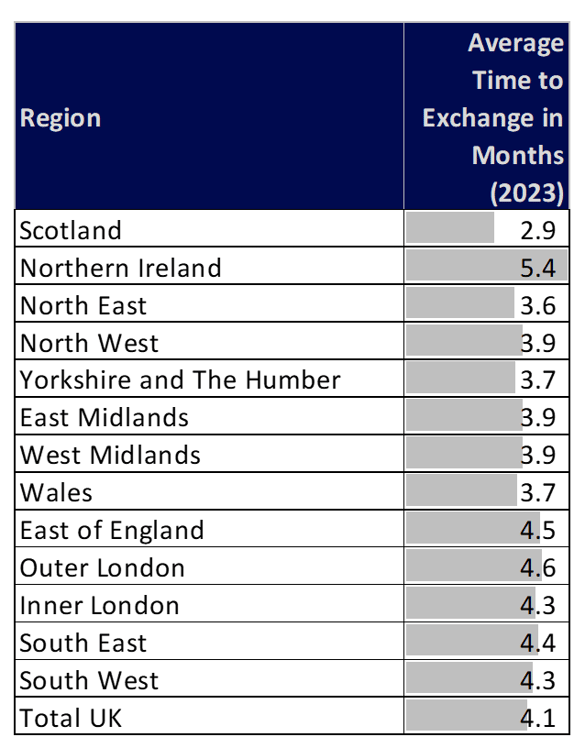

Time to Exchange

The Time to Exchange is measured by the time in days between a last sale agreed and an exchange. The average Time to Exchange in 2023 is 123 days or 4.1 months. There has been a 33% increase since 2019 but a drop from the prior year of 7%. The average Time to Exchange in Scotland in 2023 was only 2.9 months whilst in Northern Ireland it stands at a staggering 5.4 months. Check out our figures below for a breakdown of each region to see how your area fares:

Source: TwentyCi

2023 Movers Vs 2019 Movers

- People are more likely to move in Inner London, the North East and Scotland but least likely to move in the East Midlands.

- People in flats are more likely to move than those in houses.

- The most movement was observed at property values at the low end of less than £150K and the very top end, above £2m.

- Older and single people are more likely to move whilst young families are less likely to move.

The 2023 homemovers were less likely to move house with an online agent. They were also more likely to move with an independent agent than a very large corporate. This means that it’s a good opportunity for you to partner with your local independent agents. You should also look out for the rise of ‘self-employed’ agents. They will operate similarly to independents but with operating models like EXP UK, Keller Williams and Hortons.

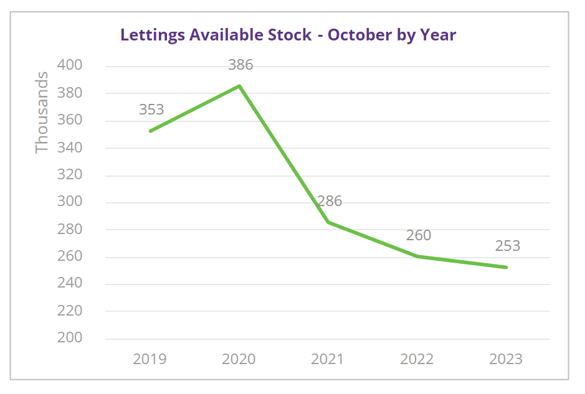

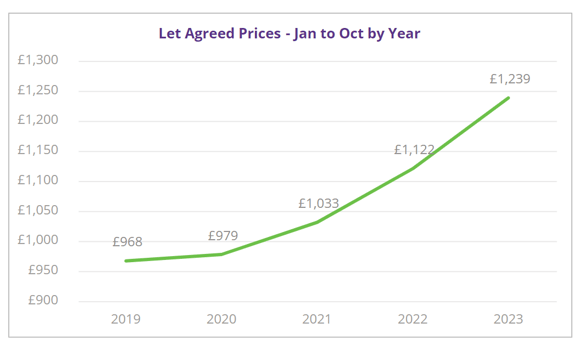

Renters

Available properties to rent is at an all-time low, with just 252,808 in total, 28% less than in 2019 and 3% lower than last year. The available stock is at a higher price point.

Source: TwentyCi

The average rent is £1,239pcm. Whilst renters are not always the popular target customer for removal companies, you shouldn’t discount them as they’re becoming like owner-occupiers, just without the big deposit.

Source: TwentyCi

Forecast

From the in-depth data that we gather, we can make some forecasts about how next year is looking.

Supply

We expect to see a modest growth of properties, with volumes for 2023 of 1.58m and a growth of 2% to 1.61m in 2024. Sellers will get more realistic about price.

Source: TwentyCi

Demand (with caveats)

The Bank of England is expected to cut interest rates from Spring/Summer 2024, so we’d expect Sales Agreed growth in 2024. This is based on the assumption that consumer confidence continues to rise and there is continued competition amongst high street lenders. We expect to see volumes for 2023 to end at 1.03m and a growth of 6% to 1.09m in 2024.

Source: TwentyCi

Transactions & Homemovers (with caveats)

Given the Sales Agreed volumes that we can already see and assuming lender competition continues, we expect 7.5% growth in the volume of transactions in 2024.

Source: TwentyCi

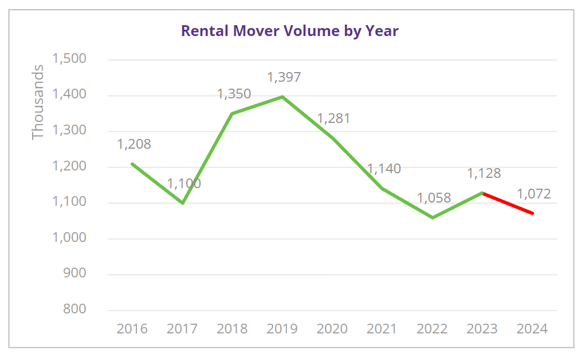

Rental Homemovers (with caveats)

Availability and affordability will continue to be the biggest challenges for the rental sector. Renters will stay put for longer which will impact supply. We forecast that there will be no huge increases in supply or reductions in demand. We expect to see the market contract by 5% in 2024.

Source: TwentyCi

Don’t sell your vans yet!

Considering everything that’s happening around us, we have seen a remarkably durable and robust property market in 2023. The future isn’t as bleak as the media is portraying it to be. Don’t be discouraged. We expect 1.10m sale homemovers and 1.07m rental homemovers in 2024 so there’s still plenty of business out there for the taking.

The team had a great time at this year’s event – there was even an Elvis impersonator to liven up the crowd! It was great to see so many of our existing clients and meet new ones. We look forward to seeing everyone in 2024.

As a moving leads provider, MoverAlerts can provide you with homemover data so you can target those on the move in your local area. We can also provide the fulfilment for your business too, saving you time and money. If you’re looking for moving company leads, get in touch with us today.