Why the Government Needs to Lift the Lock down for Home movers NOW

- Home Movers are worth c£50 billion per annum to the UK economy simply by measuring the direct impact to home moving services and subsequent retail spend

- As such, the Government needs to find an exit strategy from lock down for the housing market as quickly and as safely as possible

- Further, it would be economically sensible to stimulate the kick start of the housing market at the point of lifting the lock down measures

Overview

Dominic Raab announced on 16th April 2020 that the UK lock down would be extended for at least a further three weeks. However, we think the Government need to consider lifting the housing market lock down as soon as feasible, and here’s why.

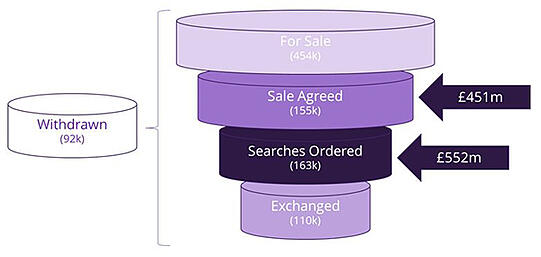

From the analysis of our data we have established that there is currently one billion pounds of Estate Agency commission locked up in the Covid-19 led housing market shutdown. Further that £552 million of this is post Legal Searches taking place. The chart below represents this…

Estate Agent Commission

There are a lot of people in limbo at the minute who do not know where their home move stands. They need an exit strategy from Covid-19, and fast!

But given the fact that the health of the nation and the continued operation of the NHS is under threat, why is this so important?

The facts are that Home Movers have a massive impact to the GDP of the UK economy, not only in the direct impact of services provided for people to move house, but also in the wider retail spending that ensues from moving home. TwentyCi place the value of home movers at around £50 billion per annum to the UK economy – which is about 2.4% of total GDP.

If you are thinking 2.4% sounds like a small number, it is most certainly not, as it is a number that rivals some previous recessions. In fact, the last recession, which resulted from the global financial crisis in 2008 had approximately double this effect on the UK economy. And I am sure people will remember the toll and the disruption to citizens lives and livelihood from 2008 and much farther beyond. As such, if the 2008 recession (considered to be quite deep) had a 5% impact on GDP, then the housing market is certainly not “small beer”.

It is not just the one billion pounds of Estate Agency commission locked up in the Covid-19 led housing market shutdown, it’s the direct home mover spend that results when people move house and this is so much more.

As such, the Government must think about opening up the housing market again in the safest way possible.

In addition, as it is so important to the economy, the Government must consider financial measures to stimulate a kick start for home movers. Temporarily removing stamp duty for example would ultimately boost retail spend directly and provide a much-needed shot in the arm for one of the sectors that has been impacted so significantly financially from the Covid-19 crisis.

The Detailed Notes

TwentyCi considered that there are three impacts of the housing market on GDP:

- The direct impact to the Housing Market itself in terms of the companies that provide services for this sector

- The direct impact of Retail Spending from home movers

- The indirect impact of spending as a result of consumer confidence increases that come from seeing an appreciation in the value of their home

The latter is extremely difficult to measure and as such we did not try to place a number on this factor.

The first two measures calculated by TwentyCi only reference people moving and the value to the economy of this aspect. They do not consider the value that the housing market affords to GDP that would have happened anyway if a move had not occurred. In other words, if the volume of transactions in the UK halves in any one year, then the impact would be half of the impact calculated by TwentyCi.

TwentyCi have measured the direct impact of housing market services by looking at Estate Agents, New House Builders, Solicitors or Conveyancers, Surveyors and Removers. Note that we have not looked at financial services as we have assumed that the number of people who have mortgages would still be the same whether or not there were 1 million property sales per annum or ½ million. The total of these service providers came to c£37.75 billion per annum, of which New Developments formed by far the largest part of this number at c£32 billion per annum.

We looked at the impact of direct retail spending in relation to a move as well, looking across Furniture, Electricals, Soft Furnishings, DIY, Kitchens & Bathrooms and Automotive. With respect to the latter, there is a strong and significant link between people moving house and buying a new or used vehicle. These products accounted for c£12.2 billion of retail spend per annum from homemovers. Where non-automotive amounts to c£3.1 billion of this number.